P2P Loans Successfully Substituting Bank Loans

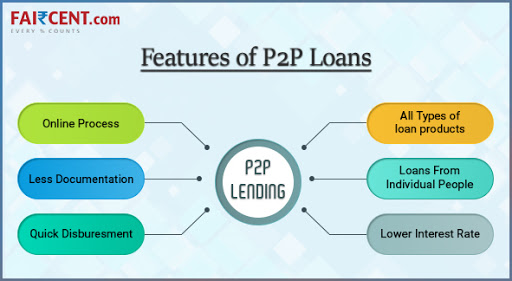

Peer to Peer (People to People) lending has blurred the identity of long-established banking players in the credit services sector. The concept is straightforward – You borrow money from the ‘people’ and pay-back to the ‘people’ by utilizing an online platform. It is necessary to state that, the P2P platforms do not lend money from their own books, instead they offer ‘online credit marketplaces’ that connect borrowers with the lenders. This collaborative approach fulfils borrower’s credit needs almost immediately and provides lenders returns that are above average market returns. On the other hand, borrowers get loans at interest rates that are favourable as compared to those offered by the traditional institutions.

P2P Personal Loans

Personal loan is a financial utility useful in converting large expenses into structured monthly EMIs. Faircent P2P Lending Platform facilitates Personal Loans with the clear ambition of making on-time availability of credit for one and all. Personal loan is one of the principal financial services offered by our platform. Additionally, we offer a plethora of services including superior user-friendly lending platform, 24/7 access to loan status, online chat support, email updates, as well as online tools for borrowers to calculate EMIs.

You may need cash for emergency medical expenses, house repair, wedding or to pay off your debt. As a P2P lending platform, we provide borrower’s personal loan request in minimum duration. You don’t have to visit a branch – From personal loan application to subsequent disbursal - everything is done online on the ‘Faircent Website ’ or the ‘Faircent App’. Since most of the process is online, the borrower gets real-time updates. Thus, Faircent P2P lending is poised to bring a paradigm shift within the lending sector.

Our online virtual P2P lending platform has already cemented its presence as a credible credit marketplace. For this reason, Faircent is the first company in India to be awarded the NBFC-P2P Certificate of Registration (CoR) by RBI. With the recent momentum gained, Faircent Peer to Peer lending platform is giving tough competition to traditional financial institutions. We are focused towards building a competitive credit marketplace that matches borrowers with lenders.

How P2P Loans are different?

P2P has brought an innovative turn in credit modelling and loan underwriting by incorporating a wide range of data elements leading to quick lending decisions. Platform requests you to enter 8-10 personal and financial data elements. As soon as the loan applicant provides all necessary documents, borrower’s profile undergoes credit risk assessment. There are 6 basic risk categories – Minimal risk, Low risk, Medium risk, High risk, Very high risk and Unrated categories, based on which interest rates are set. Multiple lenders finance a personal loan. Once the funding is 100% complete, the loan amount is deposited directly into the borrower’s bank account. Complexities rendered by larger financial intermediaries such as banks are, hence, eliminated.

P2P Going Beyond Traditional Credit Score Check

Gone are those days when the only eligibility criterion to apply for personal loans was decent credit history – CIBIL score. P2P adheres to a holistic consumer-centric risk assessment approach for determining a borrower’s credit solvency. By implementing cutting-edge technology and automated algorithms, a wide array of factors such as borrower’s gross income, credit history, debt-to-income ratio, individual expenditure, repayment ability and other relevant financial parameters are taken into consideration while assessing the creditworthiness of a loan applicant. Thus, P2P virtual credit marketplaces are gaining great traction within Indian lending market.

Get a P2P Loan Now!

Need to borrow some money? To apply for a Personal Loan, all you have to do is ‘Sign Up’. You can apply for ‘any Personal Loan Purpose’ and use it for immediate needs. Browse “Apply for Personal Loan” section on the website to register!

Related Articles

-

Faircent to utilize fresh funding raised from investors led by Das Capital & Gunosy Capital towards expanding distribution and product enhancement

Aug 16, 2019

-

P2P and Small Business: Bringing Crowd-funding to India

Jul 11, 2016

-

Making India Atmanirbhar: The P2P Lending Way

Feb 24, 2021