Investment Objective:

- The product attempts to generate risk adjusted returns by focusing exclusively on Young Professionals borrowers.

- It presents a unique feature for lenders to invest passively in a mix of young Professionals borrowers thereby diversifying risks without compromising on returns.

Product Riskometer:

This product is suitable for lenders who are willing to:

- Invest specifically in Young Professionals

- Take moderate risk

Standard Exclusions:

Following borrowers are excluded from this product:

- Selected high risk profiles

- Poor credit bureau score or recent defaults

- Non-residents Indian

- Age less than 21 years or more than 55 years

- Borrowers without KYC documents

Product Performance Trend:

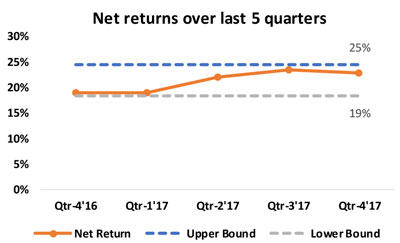

Net Returns (post default) of Professionals borrowers have increased consistently over the last 5 qtrs.

Released from January 2018

Presenting the "Salaried Millennials" P2P Loan Product:

Salaried employees belong to the least risk category borrowers and are preferred by most lenders, as they have fixed and regular monthly income. This pool becomes dynamic when young Professionals borrowers are grouped as a product. Currently, approximately 45-50% of borrowers funded on our platform are Professionals in the age bracket of less than or equal to 35 years.

Product Summary:

- Minimum investment amount is ₹30,000/-

- Maximum investment amount is ₹10,00,000/-

To mitigate investor’s overall risk, Faircent will deploy this investment into various risk categories as follows. Also, investment per borrower will be limited to ₹1,500/- to ₹10,000/- depending on the borrower risk category.

| Minimal Risk | Low Risk | Medium Risk | High Risk | V. High risk | Unrated | |

| Distribution of investment | 0-10% | 10-25% | 10-30% | 10-25% | 5-15% | 0-10% |

Lock-in and Re-investment option:

The repayments from this product will be automatically re-invested for a period of 12 months and cannot be withdrawn for 12 months. Post 12 months, you have an option to continue re-investment or make monthly withdrawals.

Investment simulation:

₹1 lakh invested in this product will deliver the following returns over 24 months.

| Highest return% over last 5 qrtrs | Avg. return% over last 5 qrtrs | Lowest return% over last 5 qrtrs |

| ₹1,48,500/- | ₹1,40,000/- | ₹1,34,500/- |

Fees & charges:

| Investment fees | 1% of the investment amount |

| Collection / recovery fees | As per terms on the website |

Product Distribution:

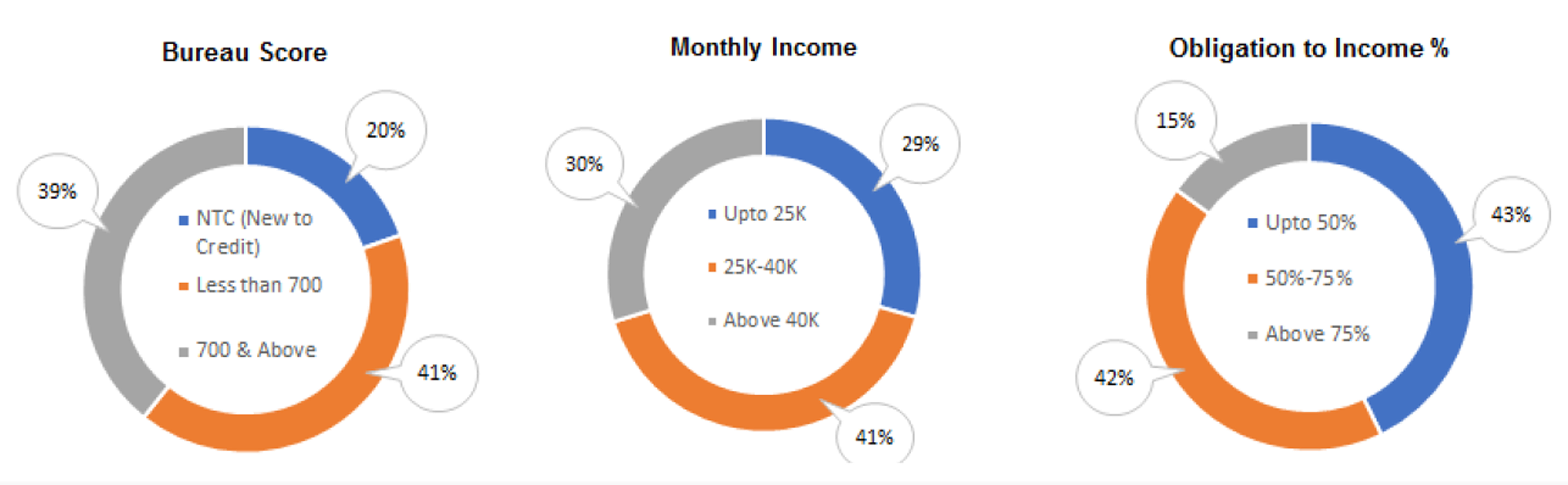

Below charts give the distribution of all young Professionals borrowers on the platform on their bureau scores (based on their loan repayment history), their monthly income & their monthly fixed obligation to income ratio.