Panel suggests sweeping changes to bring India at par with fintech rise

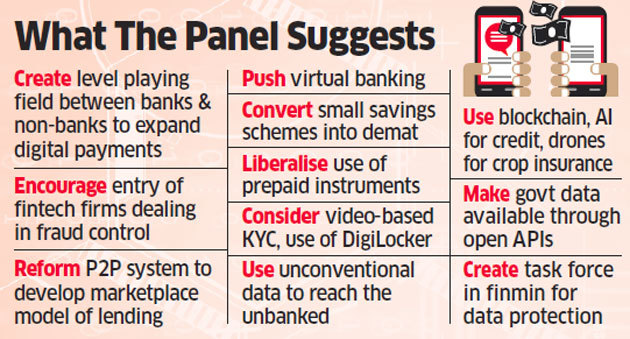

A high-level panel on fintech has made wide ranging recommendations in its report - for development of a marketplace model for peer-to-peer (P2P) lending, virtual banking to allow lenders to operate without branches, use of drones for field assessments and artificial intelligence (AI) to reduce frauds. This panel, headed by the DEA Secretary, submitted its final report to the Finance and Corporate Affairs Minister Nirmala Sitharaman on Monday, September 2, 2019.

Read more details at:

https://economictimes.indiatimes.com/news/economy/finance/fintech-panel-suggest-legal-framework-to-protect-digital-services-consumers/articleshow/70948757.cms

https://economictimes.indiatimes.com/news/economy/finance/fintech-panel-suggest-legal-framework-to-protect-digital-services-consumers/articleshow/70948757.cms

Related Articles

-

P2P Lending in India: Faircent first to get RBI nod for NBFC-P2P certification

May 22, 2018

-

Faircent brings Shalabh Gupta on-board as National Sales Head – Lending

Apr 05, 2018

-

Top 9 Things to Keep in Mind to Earn Higher Returns Using P2P Lending

Feb 27, 2019