- Faq

- Contact Us 8010052020

Looking to lend your money? Well, we have just the right lending plans for you!

Through Faircent, you can lend in loans directly given out to India’s creditworthy individuals and small businesses, and earn stable and high returns, just like you would as a bank.

Show me how you deliver

stable high returns

Various lenders, just like you, lend money in loans based on their choice of the lending plans offered

Loans are disbursed to borrowers only with a healthy credit score (rates from 10% p.a. to 36% p.a.)

Data science and algorithms automate portfolio management and optimize returns

Loans are collected back using analytics-based methods, backed by a strong recovery process

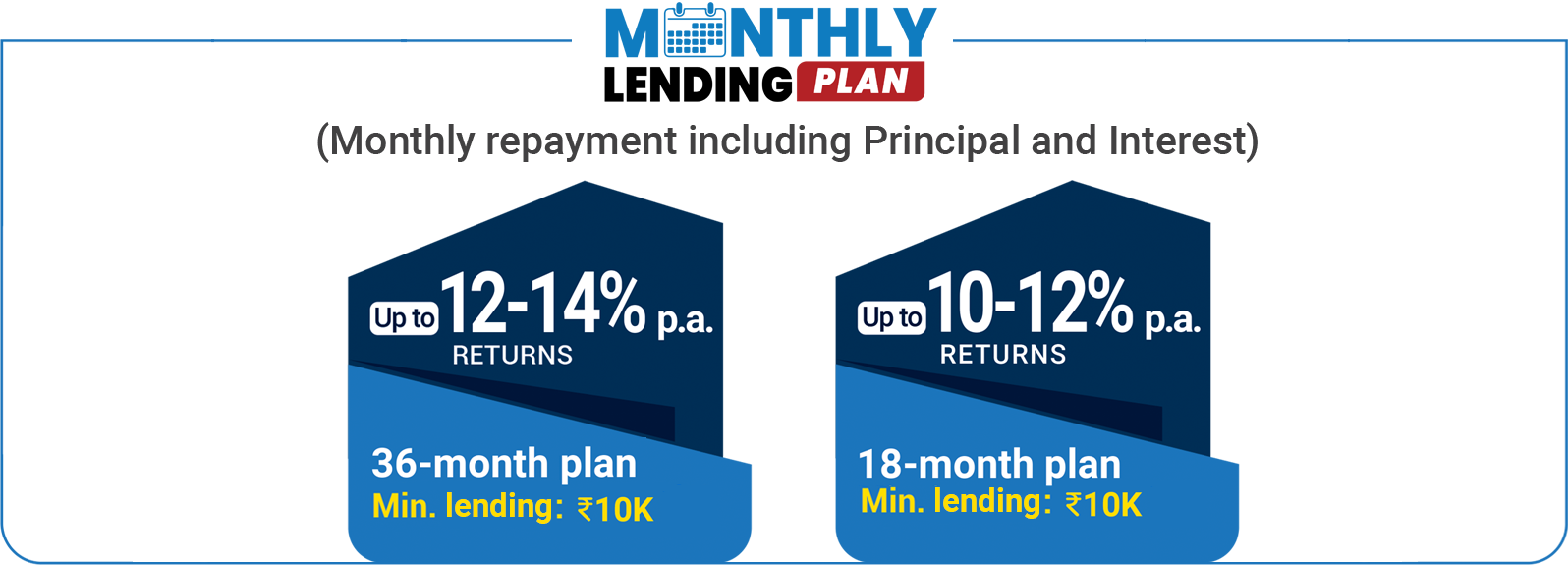

The loan repayments are collected, and you are paid back up to 10%-14% p.a., based on your chosen plan.

Our fees are fixed, and based on the principal lent by you.

Your money can be re-lent to enable it to generate compounded returns

SHOW ME THE

SHOW ME THE

CHOICE OF PLANS

You can choose your plan based on your needs. Whether it’s a fixed corpus to buy your dream car, a source of secondary, passive income, or even having the option of withdrawing money whenever you want, our range of plans suit your every need.

SHOW ME HOW YOU OFFER

COMPLETE TRANSPARENCY

Monthly in-depth status reports; no guesswork

Comprehensive Lending Dashboards, with just the date you need.

Dedicated executive to answer your questions

Performance-linked fee

Seamless liquidation on returns

Regular Loan Portfolio disclosures, to keep you updated all the time.

Aggregate portfolio mix reports covering:

- Age

- Gender

- Product Mix

- Collection Performance

- Credit History

- Education

- Employment Type

45%

Grad

37%

Undergrad

6%

Post-Grad

12%

Prof

22.95%

26-30 Years

44%

31-40 Years

21%

41-50 Years

5%

50+ Years

7.05%

21-25 Years

Self Employed (53%)

Salaried (47%)

86%

Male

14%

Female

Show me your track record

₹3,944 Crores+

Amount disbursed

2.83 Lakhs+

Lenders have joined us

48.00 Lakhs+

Borrowers have joined us

₹8.45 Lakhs+

Average Lending size

80%

Re-lending ratio

16.77%

Gross ROI of portfolio

₹89K

Average Loan Amount

Can you Answer my Questions?

Q: What is the Faircent Monthly Lending Plan?

Q: What are the key noteworthy aspects of the Faircent Monthly Lending Plan?

- 1. For repayment details, you should refer to the schedule provided with each lending in the Overview section.

- 2. Your share of the borrower EMIs will be collected and paid to you in 3rd week of the month. If your funds are disbursed to a borrower on or before 14th of the month, then you will start receiving the repayment in the next month and if they are disbursed on or after 15th of the month, then the repayment will start from the next to next month.

- 3. Your Principal outstanding (funding amount) reduces with every repayment as each repayment has a principal component. Further, you should note that you earn interest only on such Principal Outstanding.

- 4. In event of Foreclosure of a loan by a borrower funded by you, the principal and interest till date of foreclosure will be returned to you and your principal outstanding will reduce by the principal returned, with no further interest being payable to you on such amount.

- 5. In event of Settlement of a loan by a borrower funded by you, the principal and interest received till date of settlement will be returned to you and your principal outstanding will reduce by the principal returned and you may need to recognise the principal loss (if any).

- 6. Faircent Fee will be deducted on collection of EMI from borrowers and will be subject to a maximum of 1.25% per month of principal outstanding.

Q: What is the Lender processing fee payable in Faircent Monthly Lending Plan?

Q: How is Liquidity provided by Faircent?

Faircent offers Liquidity only on a best-effort basis. Faircent shall not be liable or responsible for any delay in or non-availability of Liquidity.

Disclaimer:

Lending on Faircent.com is subject to defaults. Please read the product details carefully before lending. Fairassets Technologies India Private Limited is an NBFC-P2P lending platform registered with the Reserve Bank. However, the Reserve Bank does not accept any responsibility for the correctness of any of the statements or representations made or opinions expressed by the NBFC-P2P and does not provide any assurance for repayment of the loans lent on it. Fairassets Technologies India Pvt Ltd (Faircent.com) is having a valid certificate of registration dated May 16th, 2018 issued by the Reserve Bank of India under Section 45 IA of the Reserve Bank of India Act, 1934. All repayments are subject to GST. Product returns are historic and Faircent doesn't provide any guarantee of these returns in the future. All information stated above is indicative in nature. The data provided above is purely for information purposes and being dynamic is true as of the date of publishing but can change immediately thereafter. Actual returns and pay-outs might differ depending upon the portfolio performance. Faircent will perform risk management activities to maintain returns in the acceptable range but it is possible that lenders may even lose the principal amount in case defaults are too high. Lending made in the product may get lent over a period of time depending on the amount of lending. Interest will start accruing only when the amount is disbursed to the respective borrowers on the platform. Returns are dependent on the utilization of funds. Unutilized amount does not earn any interest. By lending on Faircent, lenders authorize Faircent to send funding proposals on their behalf to borrowers meeting the lending criteria. If monthly re-lending is available, then it will be made to borrowers meeting the product's lending criteria at the point of re-lending. Maturity/Repayments are offered on a best effort basis and Faircent shall not be liable or responsible for any delay in or non-availability of the same.

By clicking the 'Lend' button, you are lending via a Faircent Product, and your lending amount will be disbursed to various Faircent borrowers or groups of borrowers as listed. By sending a proposal you are effectively accepting all loan agreements that will be subsequently generated in relation to the Faircent borrowers or groups of borrowers listed. In case you request a withdrawal of your lending amount, your rights may be assigned to other participating lenders.