Faircent Double

“Diversification is the only free lunch in investing” - Harry Markowitz, Economist & Nobel Prize laureate.

While diversifying is the key to a robust investment portfolio; building a diversified portfolio is the key to earning high and stable returns from investments in P2P lending.

However, the fact remains that individuals with limited funds to invest find it tough to achieve the efficiency of scale required to spread their investments across many borrowers. Loan delivering higher returns also come at a higher risk. Hence to earn more, risk needs to be mitigated by spreading investments more extensively. For example, data shows that to earn an average return of 14%, a lender must invest across lakhs of borrowers and loan products listed at interest rates upwards of 24%.

To invest across lakhs of borrowers, an individual investor requires a large sum of money which affects his liquidity. He also needs to put in a lot of effort. Hence, many investors lose out on an exciting opportunity for lack of time and money.

But what if, lots of investors were to pool their monies into a single portfolio to achieve efficiency in portfolio building and management. A portfolio that is built using AI and data analytics such that it can deliver higher and more stable returns. On that thought, Faircent launched Faircent Double.

What is Faircent Double?

Faircent Double aim to provide lenders with an investment option that helps them earn stable returns while maintaining liquidity of funds. Interested lenders pool in their money and authorize Faircent to disburse this into a diverse mix of loans and loan products offered to borrowers who as per Faircent’s algorithms have the repaying capacity to provide aggregate returns of up to 12% p.a.

How is the Faircent Double portfolio built?

Double portfolio leverages the power of data and analytics and is managed through a conservative approach. Using a scientific methodology to portfolio building helps mitigate risk and deliver high returns.

The salient features of Double are:

- Diversification across all loan segments basis:

- Tenure (daily to upto 36 months),

- Interest rate (12% to 36% p.a),

- Industry mix and loan sourcing

- Partners associated with the product – group term and pool loans.

A healthy mix of all the above loan classifications is maintained in the portfolio to ensure effective diversification.

- Close monitoring of each account using various data sources. Regular recalibration and immediate course correction if required.

- Transparent visibility of the portfolio performance to the lenders through monthly statements.

- Reinvestment of monthly interest received to less riskier buckets through analytics driven strategy.

- Analytics driven collection strategy and execution.

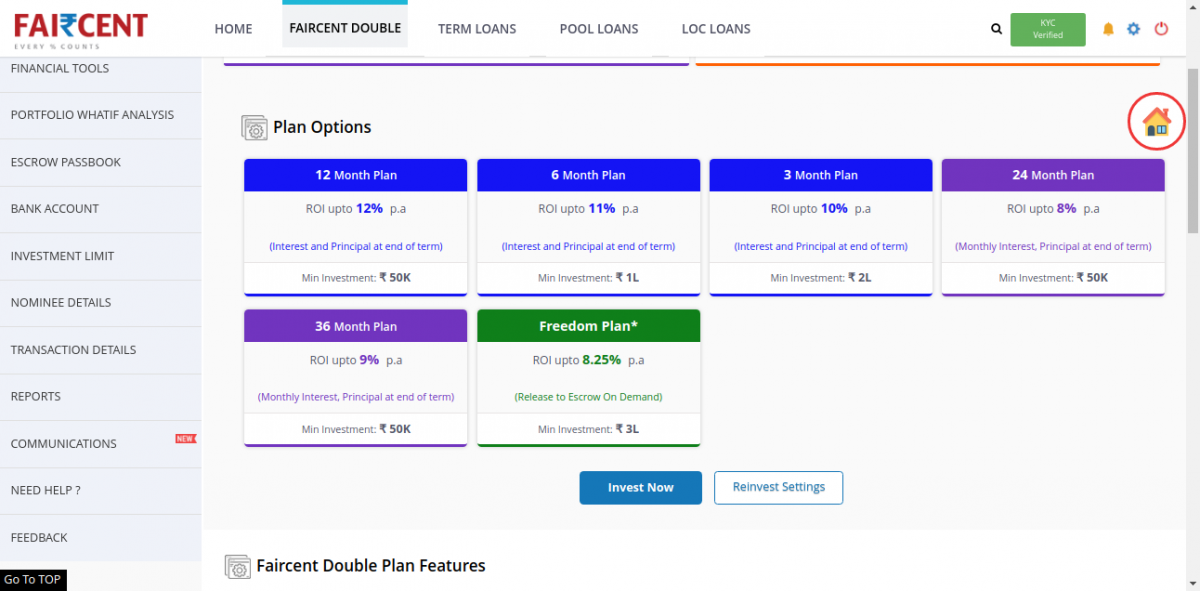

- Double comes with many versions with varied tensure options. Lenders can invest for as low as 24 hours or up to 36 months. This enables lenders to choose a plan that best meets their investment objective of earning returns while balancing liquidity of funds.

- There are Fixed tenure plans where both Principal and Interest is reinvested during the plan period and monthly payout plans where lenders can earn monthly income and interest earned is credited on monthly basis

- Depending on tenure Faircent double plans offers returns up to 12% p.a (flat)

What is the lender processing fee under Faircent Double?

There is Zero Lender processing fee for Faircent Double. Instead, a unique performance-linked processing fees for managing such pool of loans is payable. Faircent gets the difference in the interest received from the borrowers and the amount repaid to the lenders. For example, If the net returns post default, is 15% p.a and the return on loans to be provided to lender as per the plan selected is 12% p.a then the Faircenr processing fee will be 3%. Faircent Double is a not a guaranteed product. If the net returns post default is 10% p.a then the lenders will recieve 10% while Faircent fee will be nil. Hence, Faircent's fee is totally dependent on the products performance.

How to invest in Faircent Double?

Lenders invest through the Faircent Double>Invest tab on the lender dashboard. Select from the various plans visible on the screen. The lender can enter the amount they wish to invest. They can choose to fund this investment from their escrow account or add money directly from their bank account or partly through both. Click continue to recharge the amount through Net banking or PayTM and investment is done

Related Articles

-

The Product Management Team - Striving For The Customer: Part 2

May 09, 2016

-

5 Ways to Invest Like the Wealthy (and Become Wealthy Yourself!)

Apr 24, 2014

-

P2P Lending: How to get it right! Part 2: Which loans to invest in?

Aug 12, 2016