Build Your Capital Using Innovative Tools Developed at FAI₹CENT

Managing your money requires attention to detail. No matter you are investing or shopping for a personal loan online, you need to monitor every financial aspect prudently to ensure your money remain safe and profitable. And, we all know how arduous the bookkeeping job is. Thus, to build your wealth and to save your precious time, the product and technology team of FAI₹CENT has developed various high-tech financial calculators. These are profitable, practical and free tools displayed on our home page and are one of the most popular products on our website.

This will also help improve saving habits among our members because we know Every % Counts. Here is a summary on each one of them:

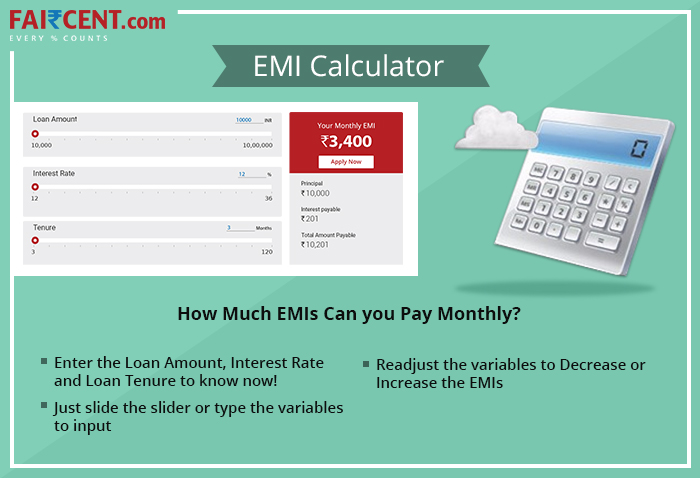

EMI Calculator

Using a Loan EMI Calculator, you can get the approximate EMI (Equated Monthly Installments) payable on your loan. It automates the EMI estimation process and gives you error free results in a split second. There are three variables of a loan –

1. Loan amount or the principal (P)

2. Interest rate (I)

3. Loan tenure (T)

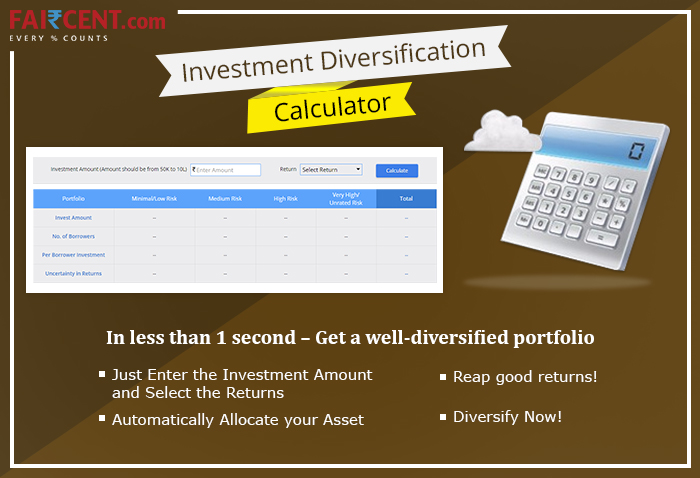

The formula used to calculate EMIs is:

However, calculating EMI using our online EMI calculator is easy. You just have to enter the various values to the EMI calculator. The calculator will process the data provided by you and run it against the EMI calculation formula automatically. Within a few seconds, you will arrive at EMIs you need to pay.

You can increase or decrease the installments payable by re-adjusting the different combinations, to ensure that the EMI payments are within your repayment preference.

EMIs on all types of fully amortizing loans - be it a business loan or a personal loan - can be calculated using this calculator. Borrowers can compare and calculate the EMIs any number of times they wish to, as there is no cost involved. FAI₹CENT’s EMI calculator is a Free Online Tool for our website visitors looking to borrow money through our platform!

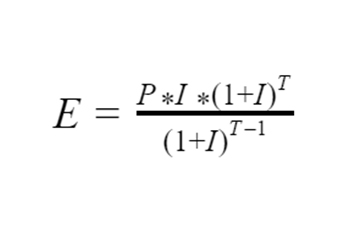

Investment Diversification

Lenders with FAI₹CENT are always looking for ways to mitigate the investment risk. Using our Investment Diversification Calculator, one can devise the investment strategy into p2p loans.

It automatically allocates your assets – that is how you should divide your money among different borrower’s risk category – Minimal risk to Very High Risk – depending upon your expected returns. In the blink of an eye, it puts together a very well-diversified portfolio, that will generate consistent monthly cash flow.

The allocation of the fund provided by the Investment Diversification Calculator is based on the past performance of the lenders and generally accepted investment principles in Peer to Peer Lending. It has been developed after doing a deep analysis of investment patterns of the lenders who have been successful in generating high returns. It is a free tool available on the website.

Wealth Builder

Have a financial target in mind? Use the Wealth Builder - another Free Calculator for the investors to gauge the prospective ‘Return on Investment’ at the end of a specific ‘Investment horizon’ for a specific ‘Monthly Amount Invested’.

Lenders who wish to reinvest their income on a regular basis can utilize this fully automated tool on Fairent.com. It helps a lender determine the future value of the invested amount. Users need to enter following key variables in the calculator –

1. Monthly amount invested

2. ROI – Return on Investment

3. Investment Horizon or tenure

You can input the values by either using slider functionality or by typing in the values. It shows the projection of the wealth gained in your monthly invested amount.

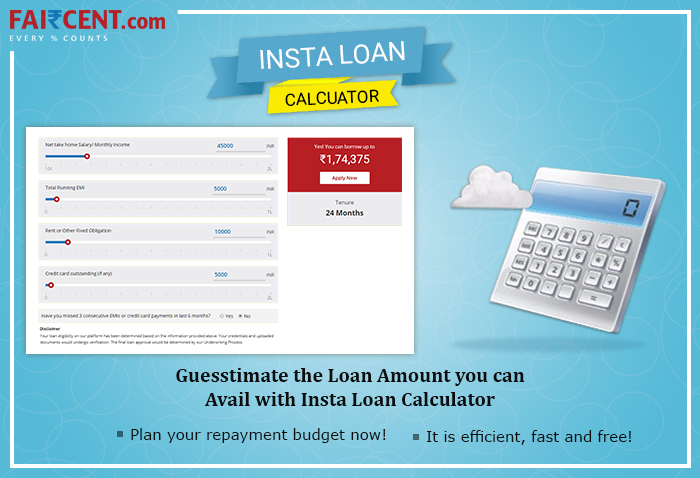

Insta Loan

Do you wish to apply for a loan? Before you apply for a loan with FAI₹CENT, you can simply check your eligibility using Insta Loan Calculator. It is designed by professionals with expertise in loan dissemination.

The loan eligibility depends on various factors. This calculator helps you to understand different combination parameters of loan eligibility to plan your repayment budget. You would need to enter the variables as delineated below –

1. Net take home salary / monthly income

2. Total running EMI

3. Rent and Other fixed obligations

4. Credit card outstanding (if any)

With the slider given in each section, you can adjust the values in the Insta Loan Calculator, or you can manually type in the values. Once you submit the required data, it shows results in the form of the loan amount in Rupees that can be taken, for a fixed tenure of 24 months. You can check the eligibility for all types of loan – Personal Loan for Marriage, Home Renovation, Home Appliance, Debt Consolidation or for a Personal Loan for business funding. It is a fast and efficient tool that allows borrowers to guesstimate the loan amount that they can avail.

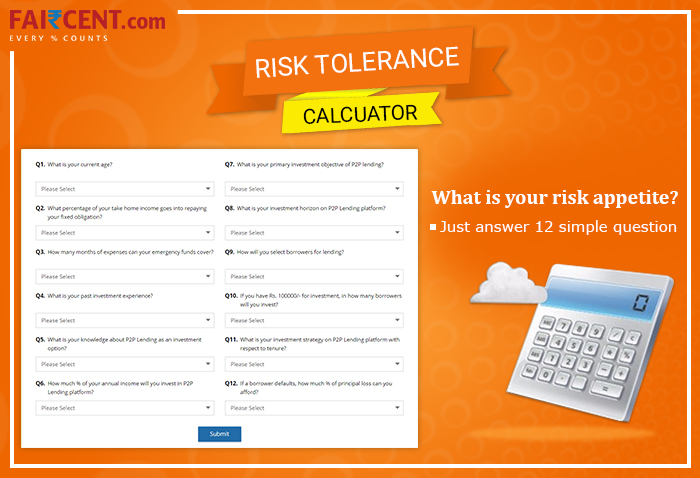

Risk Tolerance Calculator

Do you know that an investor’s risk-taking appetite generally declines with the age? So how much of a risk taker are you? The Risk Tolerance Calculator will uncover in a snap.

Every investment is exposed to some risk. It is only the degrees that differ. Consequently, it is essential to determine how much risk you can stomach? Our risk tolerance calculator will logically determine your risk propensity based on a set of 12 fundamental parameters. These include – your age, income, past investment experience, time horizon, diversification, a %age principal loss you can afford and so on. It works like a quiz.

Once you complete the questionnaire, the calculator recommends the percentage allocation of the P2P loan portfolio for every risk category. Take help of this free tool while approximating a suitable risk strategy.

Portfolio What-if-Analysis

Portfolio What-If Analysis (PWA) is a powerful analysis tool for investors to evaluate and compare a multi-loan portfolio. You can create multiple hypothetical portfolios by varying number of loans, loan amount, interest rate, tenure and start date. Each variation in these parameters has a direct impact on the returns of the portfolio. It is a good resource for the lender to analyze the correlation between risk and net returns. FAI₹CENT’s What If Analysis calculator follows a three-step process:

1. Create a portfolio

2. Add loans to the portfolio and simulate default

3. Review simulation results

A registered lender can send proposals to live borrowers after adding them to the simulated portfolio. This all-encompassing tool is very helpful in understanding the shenanigans of a portfolio of fixed income p2p loans.

Related Articles

-

Bank Shocks - The sudden emergence of NPAs and what this means for you and me

Apr 14, 2016

-

4 Must Do Before Turning 30 for All Single Ladies!

May 03, 2016

-

Celebrating Women Borrowers

Apr 07, 2021