P2P lending platform Faircent to look for more partners

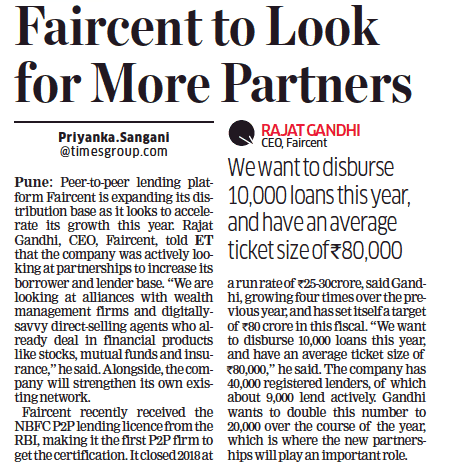

Peer-to-peer lending platform Faircent is expanding its distribution base as it looks to accelerate its growth this year. Rajat Gandhi, CEO, Faircent, told ET that the company was actively looking at partnerships to increase its borrower and lender base.

“We are looking at alliances with wealth management firms and digitallysavvy direct-selling agents who already deal in financial products like stocks, mutual funds and insurance,” he said. Alongside, the company will strengthen its own existing network.

Faircent recently received the NBFC P2P lending licence from the RBI, making it the first P2P firm to get the certification. It closed 2018 at a run rate of Rs 25-30crore, said Gandhi, growing four times over the previous year, and has set itself a target of Rs 80 crore in this fiscal.

Related Articles

-

P2P Lenders Continue to Grow Even Amid A Gloomy NBFC Environment

Oct 31, 2019

-

Faircent awards media duties to Havas Media Group

Aug 08, 2017

-

बिजनेस के लिए मिलेगा ऑनलाइन लोन, RBI की यह है तैयारी

May 05, 2016