COVID Low Impact Zone Coding on Faircent

Faircent has started a new loan offering to help small businesses and individuals access credit in districts across India which have suffered low to nil impact of COVID-19 outbreak.

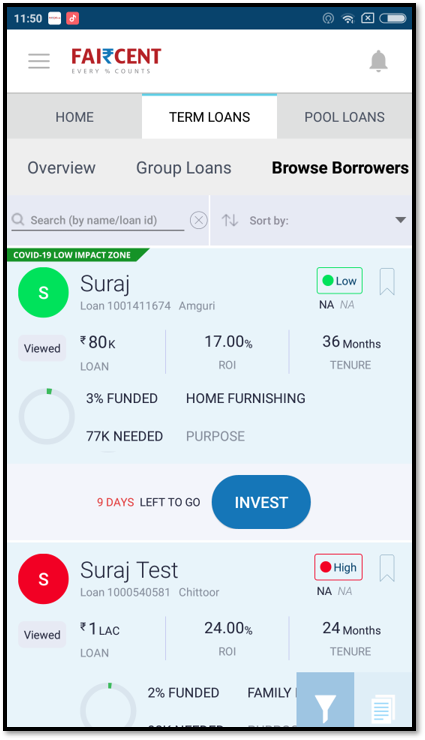

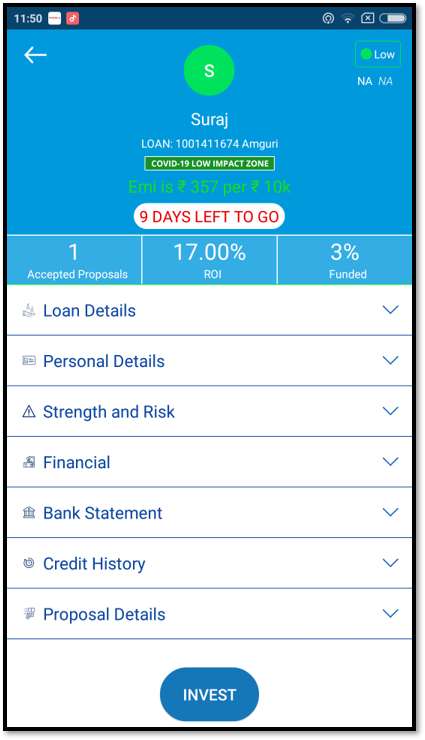

The loan targets retailers, small business owners and salaried professionals facing short-term financial constraints caused by the lockdown in areas identified as the green zones – where there have been not more than 10 COVID-19 positive cases. These borrowers will be easily visible to the lenders on their dashboard through a green color-coded tagging # COVID-19 Low Impact Zone.

There are many districts and zones in India that are unaffected by COVID-19 or have witnessed very few cases. These clusters are expected to return to normalcy much faster. Keeping this in mind, Faircent has adopted a targeted approached towards onboarding borrowers residing in these zones on a priority basis along with quick disbursal of funds.

Related Articles

-

7 Ways to Beat Inflation

Apr 11, 2014

-

Five Smart Ways To Use Your Credit Card!

Apr 19, 2016

-

What kind of loan works best on P2P Site?

Jun 23, 2016