FinTech will revolutionize lending in India

Lending is one of the oldest professions in the world and is the reason for the banking system to take shape. There is evidence of lending activities dating back to 2000BC between merchants, farmers, and traders. When lending started getting a formal structure, banks started to evolve and prosper. In fact, it is fascinating to note that the oldest bank still in existence is Banca Monte dei Paschi di in Italy which came into existence in 1472.

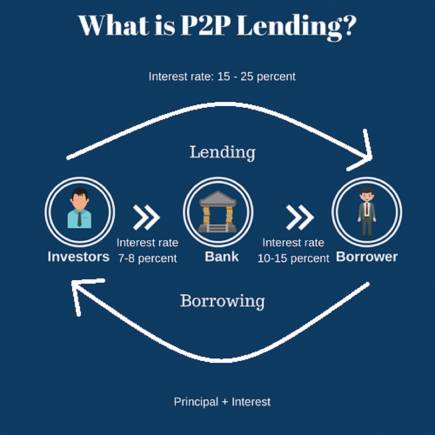

History aside, banks have flourished because people are in inherent need of few things – borrowing money, safe-keeping their money and also a system where money is easily accessible across geographies. This has pretty much remained the same over centuries and banks have made their fortunes out of it. People make deposits, the banks set-asides a portion as reserves and lend the rest on which they charge interest. They also provide a small amount of interest to the depositors, but the difference between what they make from lending out and what they pay the depositors to become their income.

However, up till now, lending as an activity has been largely consigned to the institutes of finance like banks and more recently NBFCs. The average Joe like you and me had no way to consider lending as an investment instrument and make a return on it. For investors in India, the choice was traditional investment instruments like Fixed Deposits, saving PPF etc., which deliver returns that do not beat inflation or avenues such as mutual funds and SIPs that leave too many factors out of the investor’s control. It is hardly surprising, then, that Indian investors across age groups have been demanding better investment avenues that allow them to not only save but also grow their wealth.

What changed in the last couple of years? The answer would be technology and what it could do in the financial space. In fact, a new term was coined to denote this phenomenon – FinTech.

Old, no longer gold: The rise of Fintech

One of the biggest issues with traditional avenues of capital investments is the hands-on involvement that they require. Stocks and mutual funds require investors to be ever-vigilant of market conditions and how their investments are performing. Less experienced investors have to constantly consult fund managers to zero in on the right products before they invest and the portfolio performance is heavily dependent on the acumen of the financial consultant advising the investment.

Moreover, such investments are governed to a great degree by various highly-unpredictable market factors. Investors often have to wait for long before they can realise the returns on their capital, which – averaging between 10% and 15% – are only marginally better than those offered by bank fixed deposits.

This much-delayed, high-risk approach does not suit the modern investor in this age of digital empowerment and evolving consumer preferences. They have neither the time nor the patience which instruments like mutual funds and SIPs require, and want their capital to generate the maximum dividends as soon as possible, in as risk-free a manner as possible. This is where various Fintech instruments play a part.

Image source: moneycontrol.com

The underlying processes of lending, payments, clearing, and settlement have all undergone a rapid transformation with the advent of technology. Armed with the latest digital technologies, consumer data, cutting-edge analytics, and automation, these platforms are not only providing Indian investors with a highly lucrative medium to maximise their surplus capital, but are also minimising financial risks and extending a more hassle-free experience.

Lower risk, higher gains: Why P2P lending is a must-have asset class for investors

Operating on a model similar to that of crowdfunding, online P2P lending platform connect borrowers in need of credit with individual investors possessing surplus funds. This direct approach brings down the operational cost and delivers better financial benefits to all stakeholders involved. While borrowers are able to fulfill their financial requirements at significantly lower interest rates than otherwise available in the market, lenders can generate much higher returns on their investments.

For instance, lenders on Faircent.com usually avail average gross returns of 18% to 26% per annum. This makes online P2P loans a lucrative alternate investment avenue for them. Furthermore, lenders investing in such loans start receiving interest income, as well as the principal amount, from the very next month. This means that they can reinvest their profits in additional loans, earning higher compounded Return on Investment to derive the maximum returns from their financial investments and give their wealth-generating goals a big boost.

What makes online P2P Lending even more lucrative as an asset class for potential investors is the fact that it offers lenders the opportunity to diversify their investments across multiple risk buckets and loan requirements. This diversification helps in minimising the risk of a big-ticket financial loss by spreading the fund across multiple borrowers.

Borrowers are rigorously and thoroughly vetted through proprietary algorithms and physical verification before their loan requirements are approved and listed. Lenders are also given transparent access to all the collected borrower data, including creditworthiness and the ability/intent to repay, enabling them to make more educated, data-driven, and accurate lending decisions.

For new-age investors attracted to the convenience of leading online, P2P lending platforms allow them to tap into this demand for credit using technology. Leveraging cutting-edge tools like data analytics, machine learning, and automation, leading P2P lending platforms are now making it easier for investors to zero in on the best-suited investment option for them.

Processes like Auto-Invest launched by Faircent.com has simplified investing to such a great extent that all lenders now have to do is enter their preferred parameters – what kind of loan categories they want to invest in, how much, and across what risk buckets – and leave it on the platform algorithms to take care of the rest. This frictionless, on-demand approach frees investors from the hassle of having to manually go through borrower data before making an investment. also enabled lenders and borrowers to trade on the go, leading to a seamless and highly-personalised user experience.

And the Future seems bright

Having a product is one thing, but do people actually want to borrow? How does the credit scene look like especially when the economy is in a bit of a flux? According to Tradingeconomics, an online platform that provides historical data and economic forecasts, the value of loans in India increased 11.10 % year-on-year in the two weeks to January 5, 2018. Loan growth in India averaged 11.60 % from 2012 until 2018, reaching an all-time high of 18.70% in April of 2012 and a record low of 4.10% in March of 2017. According to RBI, Personal Loans increased by 17.3% in November 2017 as compared with the increase of 15.2% in November 2016

The demand is growing exponentially from both retail borrowers and SME/MSMEs increasingly shifting to online platforms to meet their credit requirements. All that remains to be seen now is how Indian investors will capitalise on this mammoth opportunity to secure their financial futures.

This article was published in moneycontrol.com on Feb 03, 2018

Related Articles

-

Financing MSMEs: Banks & FinTechs – Competition, Collaboration or Competitive Collaboration?

Feb 21, 2017

-

What the future holds for P2P lending in India and the World

Jun 16, 2017

-

How can P2P sites guard against bad loans

Jun 06, 2016